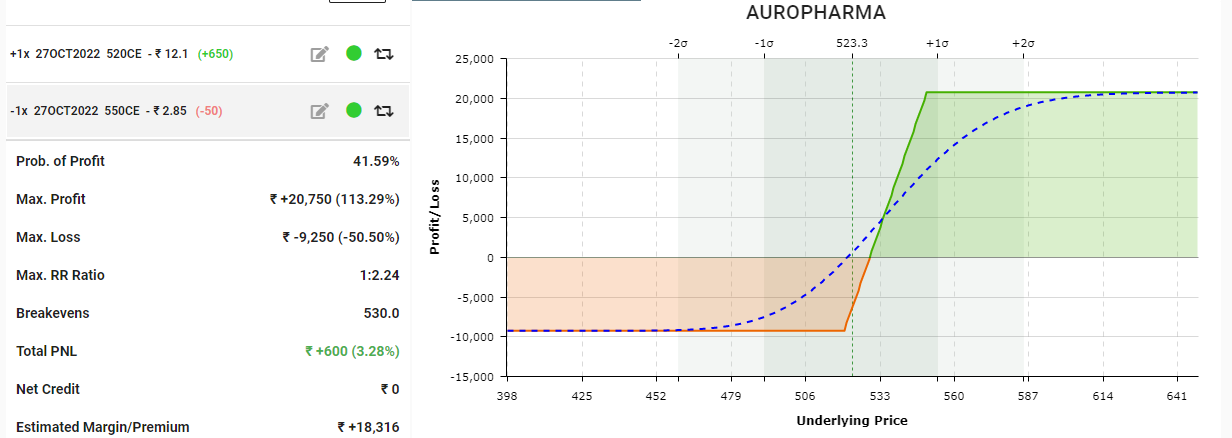

Auro Pharma Options Spread Strategy

Auro Pharma Options Spread Strategy:

Buy 520 CE 12.1 (Premium May Vary)

Sell 550 CE 2.85 (Premium May Vary)

MAX Profit: 20,750/-

Max Loss: 9250/- + Tax

Margin Used: 19,000/-

Lot Size: 1000

Expiry Date: 27 Oct 2022

Considering the price action, we are assuming prices can go up side so rather than going future long, we can execute bull call spread here! Kindly look to the spot price of the stock as below,

View will become invalid if price goes below 595 and You may wish to book the profit near 560.

We would recommend you to keep this trade on your watch list.

We are going to conduct “Live Market Options Trading” on this expiry 20 Oct’22. This session is going to be completely focused on “Options Buying” where we will be demonstrating "Live Options Trades", Click on the image below to enroll.

Disclaimer: This blog is created just for learning purpose, which would help you understand how to analyze stocks before taking trades. This is not any buy and sell recommendation, the author of this post is not responsible for any profit or loss incurred. Please consult your financial advisor before making investments.

Categories: : Stocks For Watchlist

Yagnesh Patel

Yagnesh Patel